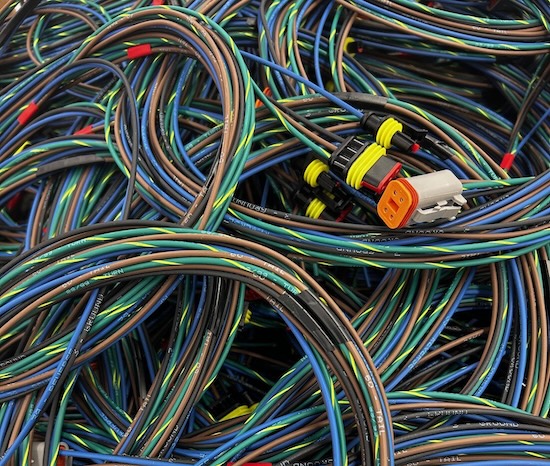

- Morgan Royce Industries is a manufacturer of cable assemblies and box builds for the semiconductor equipment industry

- TACK Electronics is a manufacturer of custom wire harnesses and cable assemblies for customers in the aerospace and defense, gaming, medical, transportation and battery/energy equipment industries

- Acquisitions follow Auxo’s recent purchase of Golden State Assembly, a vertically integrated wire/cable assembly and harness manufacturer

- Latest deals are part of Auxo’s continued acquisition strategy to build a diversified leader in the wire harness industry

- Acquisition of TACK brings together Auxo’s two funds, Auxo Growth Holdings and the Michigan Opportunity Fund, into a common wire harness platform

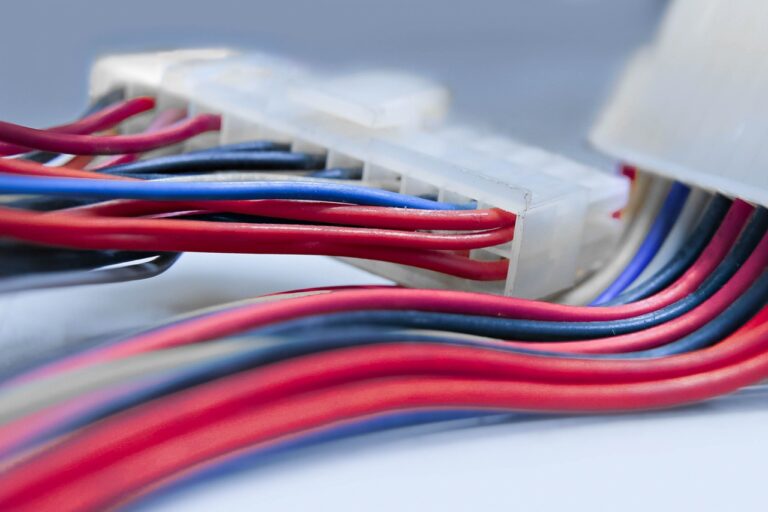

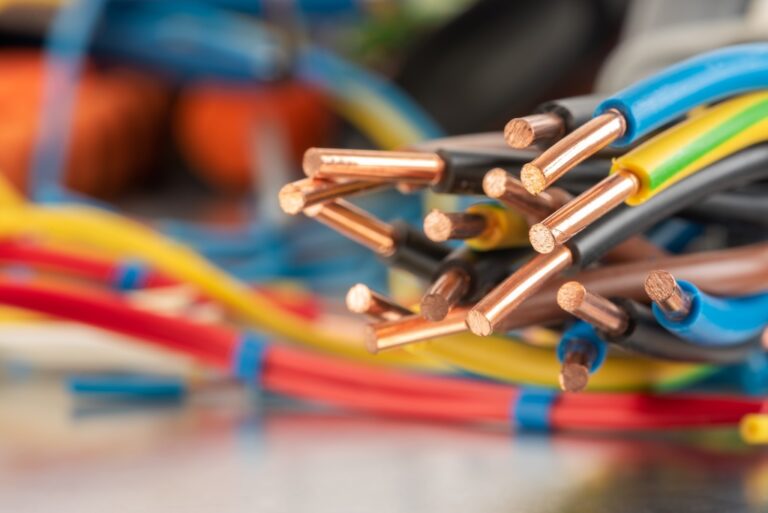

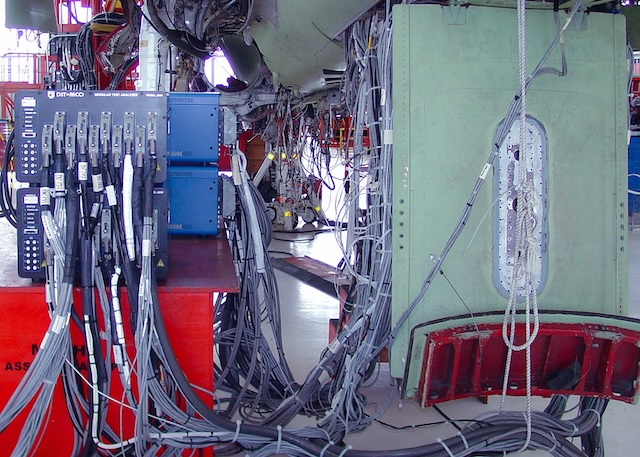

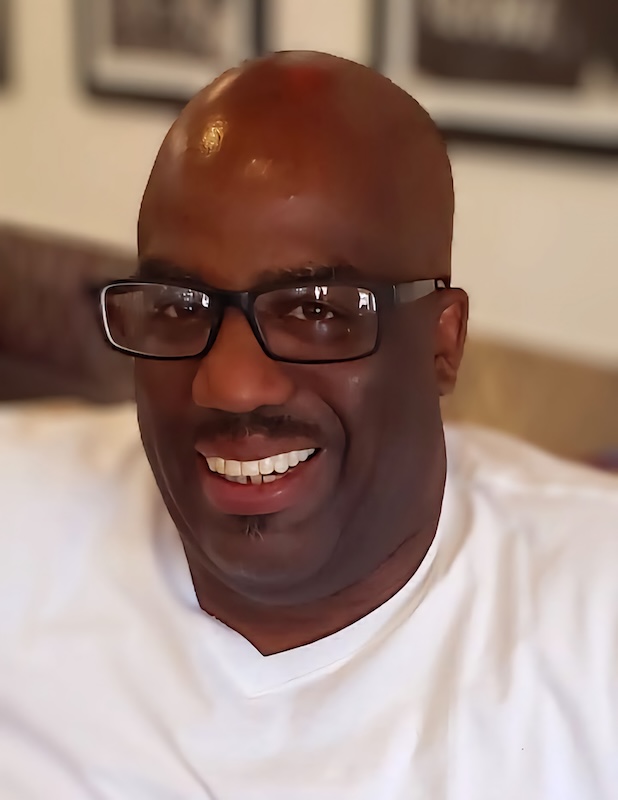

Private investment firm Auxo Investment Partners announced today that it has acquired Morgan Royce Industries (MRI) and TACK Electronics (TACK), two manufacturers of custom wire harnesses, cable assemblies and box builds fabricated for the semiconductor equipment, aerospace and defense, gaming, medical, transportation and energy equipment industries. These additions follow Auxo’s purchase of Golden State Assembly—a vertically integrated, complete lifecycle wire/cable assembly and harness manufacturer—and expand Auxo’s growing wire platform. The respective CEOs of MRI and TACK, Larry Johnston and Todd Maines, will remain in their current roles.

Partnering with MRI

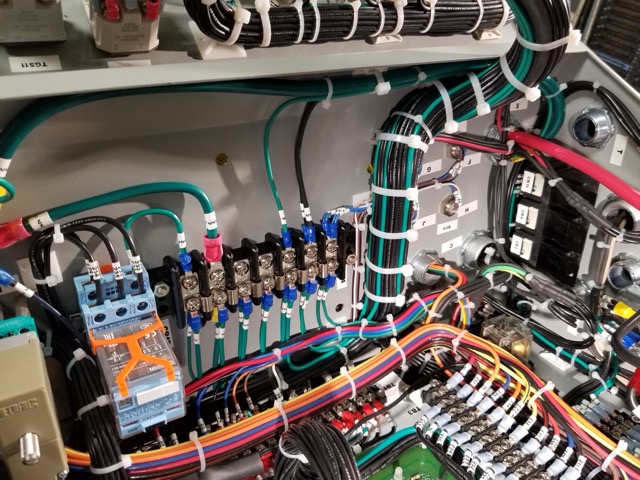

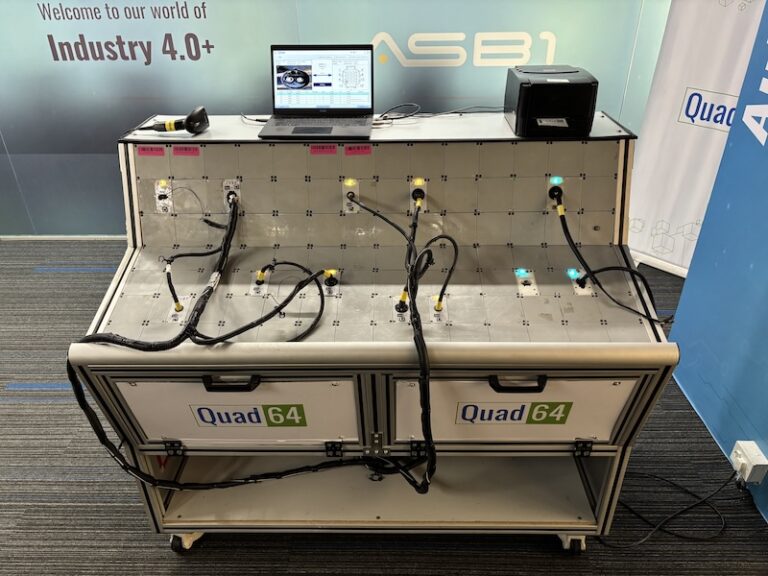

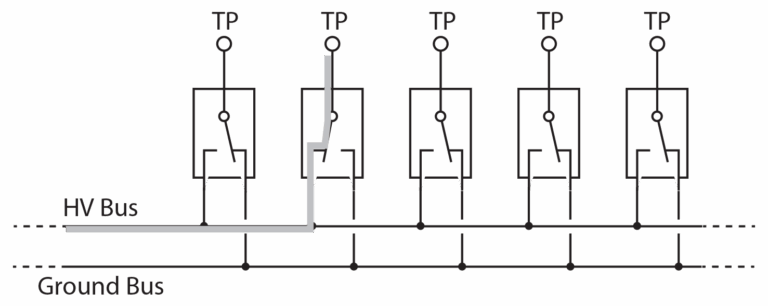

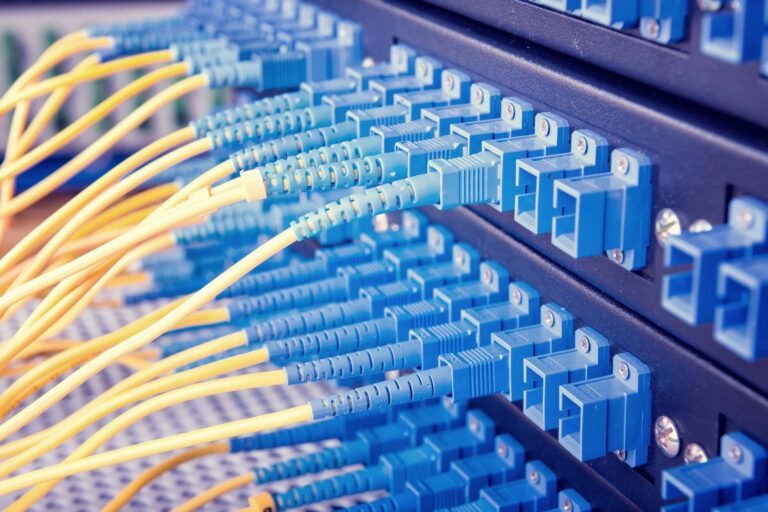

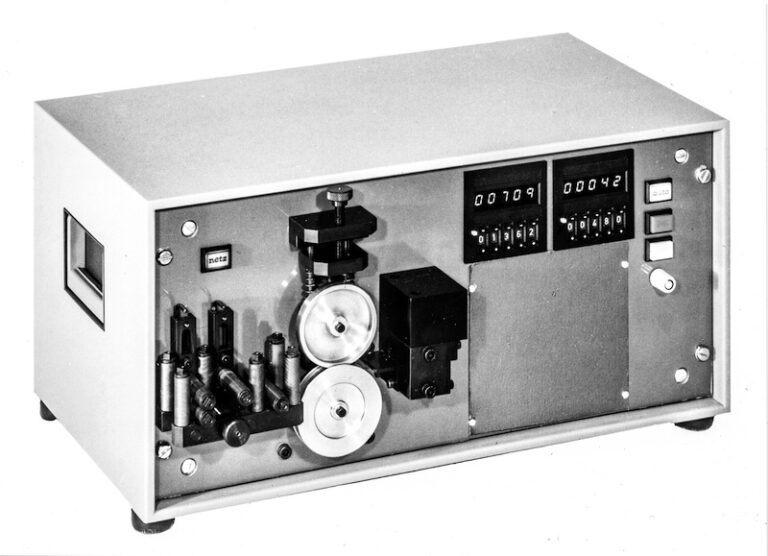

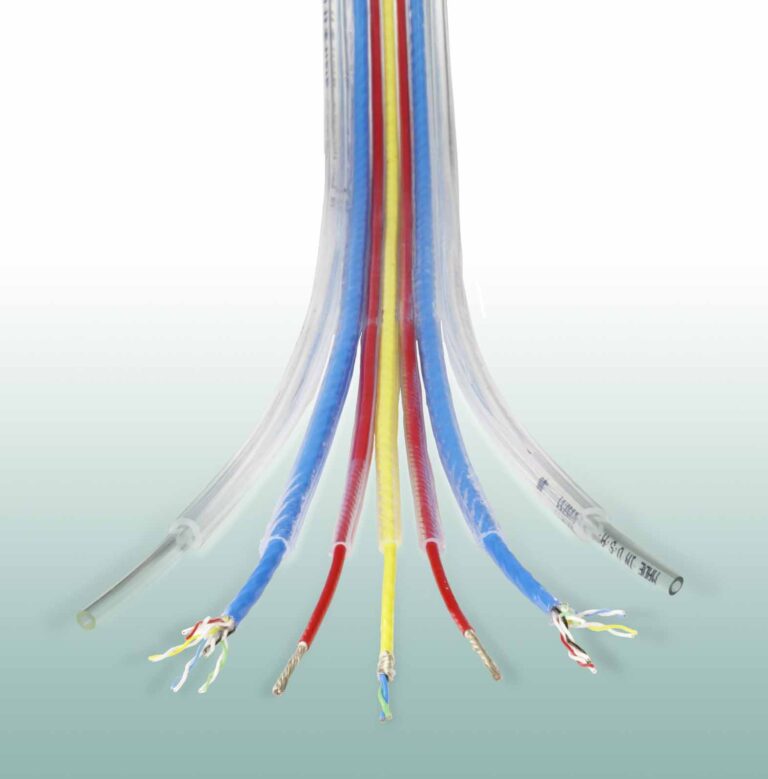

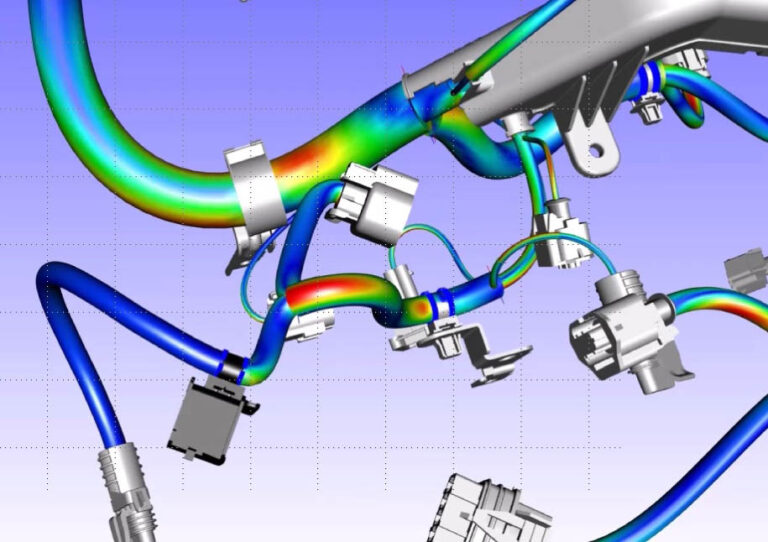

Headquartered in Fremont, Calif., MRI manufactures wire harnesses and box builds—complete assemblies of cables, electronic components, and metal/plastic housings—for the semiconductor manufacturing equipment industry. The company also serves customers in the medical equipment, telecommunications and power industries.

The deal comes as a flurry of new investments in the U.S. semiconductor industry totaling over $200 billion are slated to close by 2025. Passage of the CHIPS and Science Act will also provide the sector with $76 billion in subsidies that are expected to triple the number of U.S. chip manufacturing facilities over the next decade. These favorable tailwinds—along with the growth of connected “smart” products in adjacent industries and recent re-shoring trends—offer GSA significant opportunities for expansion in the semiconductor manufacturing equipment industry.

“We are excited to join GSA and continue providing outstanding manufacturing services to our semiconductor manufacturing customers around the globe,” said Johnston. “Auxo’s collaborative spirit and philosophy of partnering with founder-led businesses—as well as GSA’s impressive track record as a time-to-market leader in complex cable harness manufacturing—will not only accelerate our continued growth, but also greatly expand our ability to serve the thriving semiconductor equipment industry.”

Teaming Up with TACK

Founded in 1996 and based in Grand Rapids, Mich., TACK is a manufacturer of wire harnesses, cable assemblies and box builds that specializes in high-mix/low-volume products for a variety of industries, including aerospace and defense, gaming, medical, transportation and battery/energy equipment.

TACK’s established reputation for quality, innovation and service has fueled the company’s most recent growth, more than tripling its revenue over the past three years. Further, the company is known for its strong base of defense customers, which it serves from its International Traffic in Arms Regulations (ITAR) certified facility in Grand Rapids.

“Our team has done an outstanding job developing lasting relationships with our customers and creating long-term value for them,” said Todd Maines. “At TACK, we believe in ‘Achieving Success Together’ with our clients. As such, we take great pride in understanding our customers’ needs and integrating ourselves as an extension of their manufacturing operations to meet those needs.”

“These new partnerships with MRI and TACK shore up GSA’s position as one of the country’s leading wire harness platforms, and further diversifies its array of service offerings” said Jeff Helminski, co-founder and managing partner of Auxo Investment Partners. “MRI’s complementary capabilities and longstanding foothold in the semiconductor industry are a tremendous asset to the platform—particularly as we look to scale GSA’s skillset and capacity and expand its customer base. TACK’s track record of providing white-glove customer service and achieving stellar growth makes it the perfect fit for GSA which, as a time-to-market leader, aims to get its products into customers’ hands swiftly and in turn, bring down its cost curve. We look forward to working with Larry and Todd and drawing on Auxo’s growth-focused playbook to strengthen both companies’ preexisting customer relationships and expand their market share.”

“We are thrilled about our new partnership with Auxo,” added Maines. “Their sophisticated team delivers the perfect blend of support and guidance, which will undoubtedly enhance our operations over the coming years. With GSA, MRI and TACK under the same banner, we’ll be able to provide greater capabilities for our customers and strengthen our position as a leading provider of wire harnesses and cable assemblies.”

Seizing New Opportunities in the Semiconductor, Defense, and Transportation Industries

Chip demand is projected to increase over the coming decade, largely driven by demand in automotive, computing and military-industrial applications. This increase in demand is expected to have a positive impact on the long-term growth and profitability of semiconductor manufacturing equipment suppliers like MRI. Furthermore, the CHIPS and Science Act is expected to spur a significant increase in semiconductor manufacturing capacity through billions in subsidies.

The events of the past few years have highlighted the critical importance of maintaining strong defense and transportation industries in the U.S. Both sectors are expected to continue growing rapidly over the coming years with companies in the space bringing new, innovative products to market. TACK’s experience supporting customers in these industries will enable the company to build on its recent history of strong growth.

“The customers that TACK and MRI serve are some of the most exciting companies driving innovation in their respective industries. Together, GSA, TACK and MRI will be well-positioned to serve these customers and capitalize on the adoption of their products,” said Jack Kolodny, managing partner of Auxo Investment Partners. “As part of a common platform, the companies will be able to meet growing demand from new and existing customers, realize new operational efficiencies, and foster deeper relationships across industries. We are excited to partner with the teams at MRI and TACK as part of our ongoing acquisition strategy aimed at growing market share in the highly fragmented wire harness manufacturing industry.”

Investing Through the Michigan Opportunity Fund

TACK’s acquisition was completed through Auxo’s Michigan Opportunity Fund (MOF) which closed in 2022. The MOF invests in Michigan-based—and largely family-owned—businesseswith strong growth potential that stand to benefit from Auxo’s operational focus and long-term partnership approach. The acquisition brings Auxo’s two funds, Auxo Growth Holdings (AGH) and the MOF, into a common wire harness platform.

Advisors and lenders on the transaction included Miller Johnson PLC, Barnes & Thornburg LLP, BDO USA LLP, Advantage Benefits Group, Aon Plc, Krauter & Co., Strategies Wealth Advisors, Thomas Brady & Associates, and Mercantile Bank of Michigan.

With the addition of MRI and TACK, Auxo has acquired 20 companies which comprise several leading platforms and brands. Together, GSA, MRI, and TACK make up Auxo’s Wire platform, a growing and diversified provider of complex wire harnesses and cable assemblies. Auxo’s Precision Products Group, a brand of specialty manufacturers producing niche products, consists of Breyden Products, Euclid Medical, Saylor Technical Products and Paramount Tube. In late 2021, Auxo acquired Genesis Rail Services and Ferrovia Services as part of its burgeoning Railroad Maintenance platform. Additionally, the firm has acquired Bernal Rotary Dies, Atlas Die, AtlasFlex, Midway Rotary Die Solutions, DieCraft Engineering & Manufacturing, and GC Dies, which comprise its Impact Converting and Systems Solutions platform. Its marine platform, Auxo Marine, was formed via the acquisitions of M/G Transport Services (which sold to Maritime Partners in Q4 2022) and Andrie. Other acquisitions include Altus industries, Prestige Stamping and its sister company, Securit Metal Products.

A Long-Term, Collaborative Approach

Auxo was named after the ancient Greek goddess of growth, and the firm seeks to partner with companies that meet the following investment criteria:

- North America-based

- Manufacturing, industrial, value-added distribution or business services industries

- EBITDA (cash flow) of $2-$20 million

- Owner-operators seeking retirement, family succession planning solutions, or existing teams seeking to grow their businesses

- Prefer majority-control investments but will consider select minority-partner opportunities

About Auxo Investment Partners

Auxo Investment Partners is a Grand Rapids, Michigan-based private investment firm that partners with owners and management teams of companies at transition points in their history. Auxo’s flexible capital model allows for long-term, growth-oriented decision-making without artificial deadlines. The structure was specifically designed for family businesses facing a generational transition or management teams seeking a partner to fuel growth and achieve their full potential with a long-term investment approach. Auxo’s unique philosophy aligns the interests of its companies, their employees, the communities in which they are located and its investors to achieve optimal outcomes for all. As our name reflects, we are not merely investors, but partners. For more information, please visit www.auxopartners.com.