For both the Komax Group and the Schleuniger Group, the market for automated wire processing offers many opportunities, but these require significant investment. In or- der to exploit these opportunities with the necessary speed and thereby secure com- petitiveness over the long term, the two companies are seeking to implement a quasi- merger. With their combined innovative strength, solutions for further increasing the degree of automation in wire processing on a lasting basis will be brought to custom- ers more rapidly. To finance the merger, Komax will propose to the Annual General Meeting of 13 April 2022 the creation of new shares by means of a capital increase. These shares will be allocated in exchange for the Schleuniger shares of Metall Zug AG, giving Metall Zug AG a 25% stake in Komax Holding AG. In addition, the Annual General Meeting will be asked to rescind the 15% voting rights restriction and elect Jürg Werner, the current Chairman of Schleuniger AG, as an additional member of the Board of Directors.

In order to secure their long-term competitiveness and continue to consistently drive forward the automation of wire processing with cutting-edge products and solutions, Komax and Schleuniger are seeking to merge. To this end, Metall Zug AG will bring its Wire Processing division, the Schleuniger Group, into Komax Holding AG and receive a 25% stake in Komax Holding AG in return. Komax and Metall Zug have signed the corresponding agreement. The transaction will be carried out through a quasi-merger. This will involve Komax Holding AG creating 1,283,333 new shares through a capital increase – subject to the approval of the An- nual General Meeting of 13 April 2022 – and then allocating these shares to Metall Zug AG in exchange for the Schleuniger shares.

Trends require a high level of investment and personnel resources

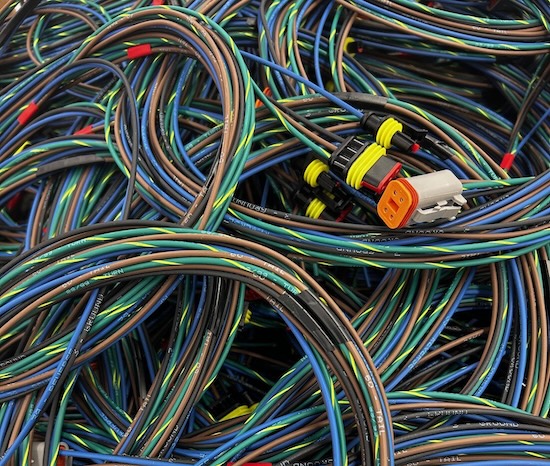

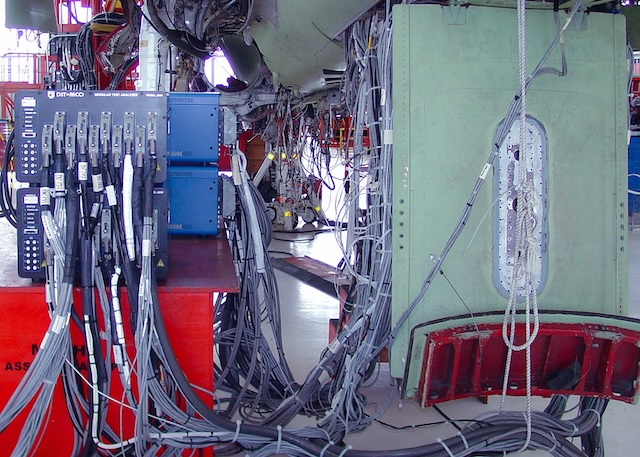

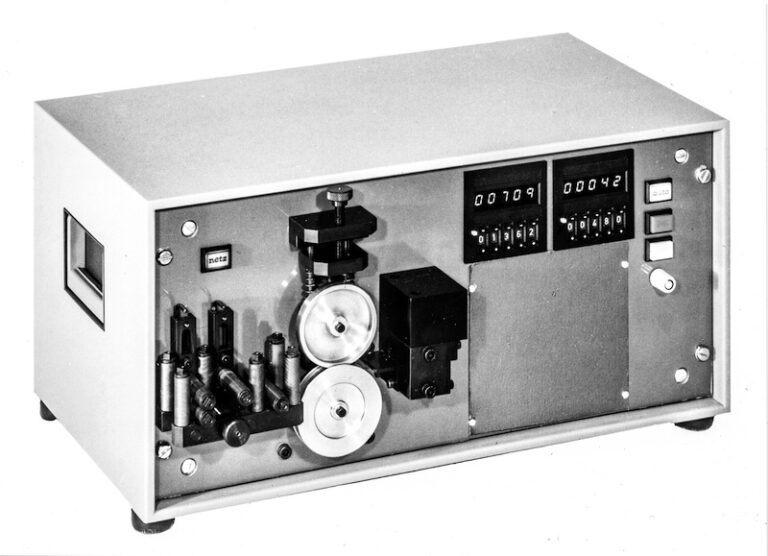

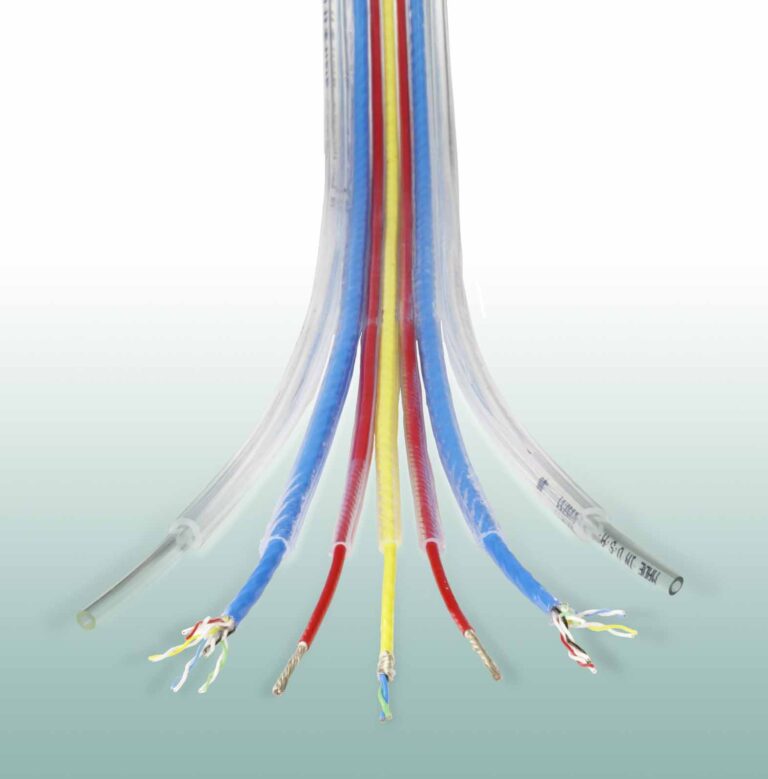

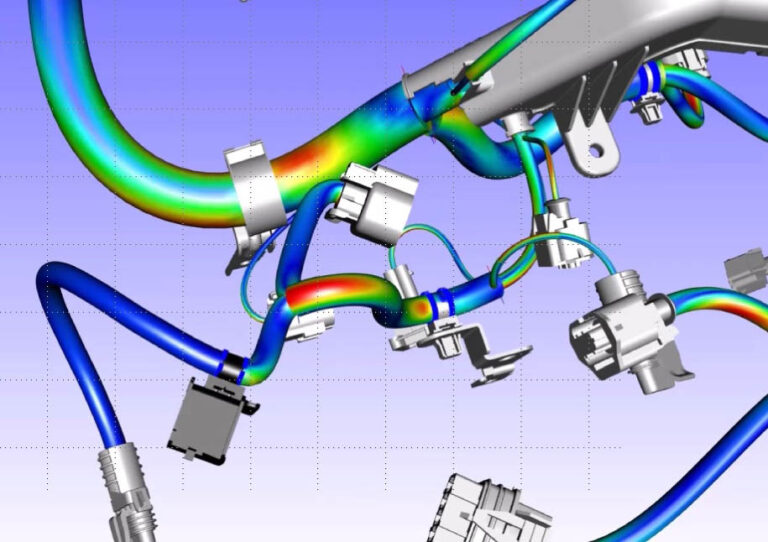

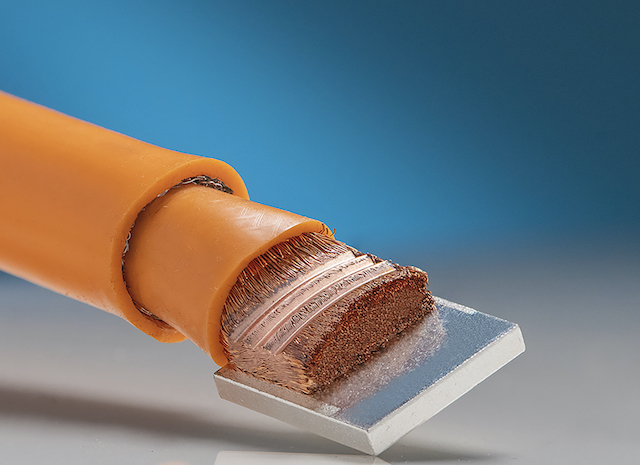

A number of trends offer numerous opportunities for Komax and Schleuniger. In order to ex- ploit these and be in a position to meet customer needs with sufficient rapidity across the necessary breadth, a high level of investment and personnel resources is required. One of the trends is the ongoing shift of the automotive market to Asia. Companies that want to as- sert themselves in the growing Asian market and avoid the risk of gradually losing market share must invest in new solutions and services. Another trend is automation. This has picked up pace in recent years, and offers considerable growth potential due to the increas- ing global shortage of specialist personnel. “Through this merger, Komax and Schleuniger will have additional expertise and more resources to support their customers with innovative products and services in various market segments as the degree of automation continues to rise,” comments Beat Kälin, Chairman of the Board of Directors of the Komax Group. The trends of digitalization, autonomous driving, and e-mobility also offer potential for growth and differentiation. These opportunities call for significant investment and the further recruitment and development of highly qualified specialists.

Komax Holding AG, Industriestrasse 6, 6036 Dierikon, Switzerland Phone +41 41 455 04 55, komaxgroup.com

Ensuring competitiveness

“The merger will put us in a position to respond to all these trends appropriately – and most importantly of all with the necessary speed so that we can preserve our competitiveness,” explains Matijas Meyer, CEO Komax Group. “As a result, the customers of the merged com- pany will continue to have a reliable partner that can impress them with innovative products and services.” This innovative strength and securing of competitiveness will also have a posi- tive impact for shareholders and employees. The merger lays the foundations for growth over the long term, investment in the future, and the creation of further jobs and apprentice posi- tions. The combined workforce of more than 3,000 employees will be given additional devel- opment opportunities in a cutting-edge technology group, and will have a key part to play if the available opportunities are to be exploited.

One share, one vote

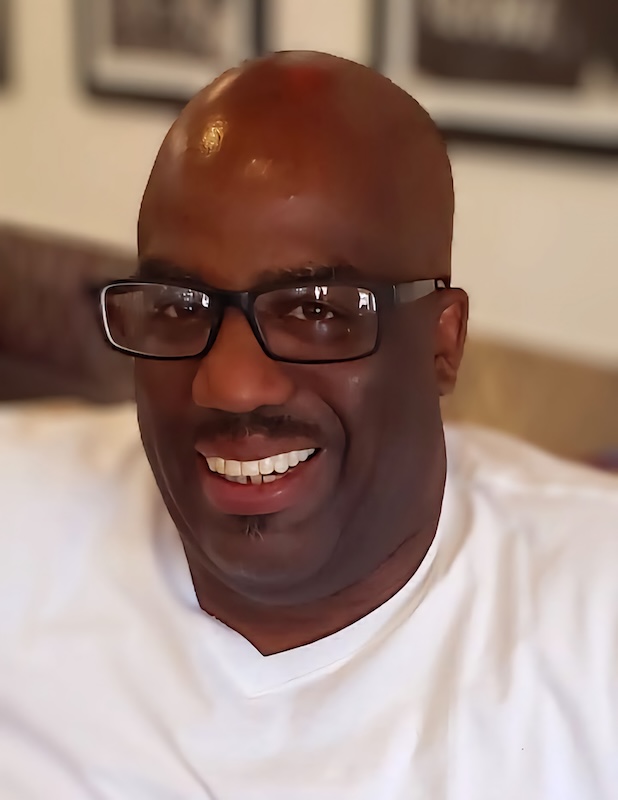

In addition to the capital increase, Komax will also propose to the Annual General Meeting that the existing voting rights restriction of 15% be rescinded. This will have the effect of strengthening Komax’s corporate governance, in keeping with the principle “one share, one vote”. In addition, subject to successful implementation of the merger, Komax will propose the election of Jürg Werner to the Board of Directors. Jürg Werner is Chairman of the Board of Schleuniger AG, a member of the Board of Directors of V-ZUG AG and Haag-Streit Hold- ing AG, and served as CEO of Metall Zug AG from 2013 to 2020. He holds a degree in elec- trical engineering as well as a PhD (Dr. sc. techn.) from the Federal Institute of Technology (ETH Zurich). Beat Kälin as Chairman of the Board of Directors and the other five members of Komax’s Board of Directors will stand for re-election.

Anchor shareholder with a long-term focus

With Metall Zug, Komax will have an anchor shareholder with a long-term focus. In keeping with its new strategy communicated in 2019, Metall Zug is transforming into a holding com- pany with significant stakes in attractive Swiss industrial companies. The first step in the im- plementation of this strategy came in 2020 with the spin-off and the independent stock mar- ket listing of V-ZUG, in which Metall Zug has held a 30% stake since then. The second step in the implementation of this strategy will now take place with the planned strategic stake of 25% in Komax following the merger with Schleuniger. “Metall Zug intends to hold its stake in Komax for the long term as an anchor shareholder,” emphasizes Martin Wipfli, Chairman of the Board of Directors of Metall Zug AG. “We were therefore happy to accede to the request to commit to a six-year lock-up period, during which we will essentially not sell any shares.”

Subject to the Annual General Meeting approving the capital increase, the merger will then be reviewed by the relevant competition authorities. The transaction will be executed once this process is complete, which is likely to be the case in the third quarter of 2022. Until then, Komax and Schleuniger will remain independent of one another, and no shared business ac- tivities will take place.