How wire harness manufacturers can achieve success amid a changing Nylon 6/6 market

by Robert Rensa – Panduit

Created as an alternative to silk in the 1930s, the practical applications for Nylon 6/6 weren’t as vast then as they are now. In fact, prior to becoming one of the most in-demand substances on the planet, the polyamide found itself most useful in 1940s wartime.

Primarily used when high mechanical strength, great rigidity, and good stability under heat are required, today Nylon 6/6 is one of the world’s most critical components when it comes to the creation of fiber applications, industrial applications, and engineering material. But beyond that and its use in industrial applications, power tools, and cable ties, the material is perhaps most crucial to the auto industry.

Much of the Nylon 6/6 that is globally produced eventually finds its way into auto applications like air intake manifolds, ball bearing cages, bushings, gears, electrical components, oil pans, and other various machined parts and under hood components. And while its resistance to heat, oil, and grease is especially useful in automobiles, perhaps its greatest offering to the industry is its ability to help improve fuel efficiency, increase design freedom, and reduce manufacturing costs. Not to mention, as safety regulations and standards become more stringent and widespread worldwide, the need for it will only increase because of how critical it is to the production of airbags.

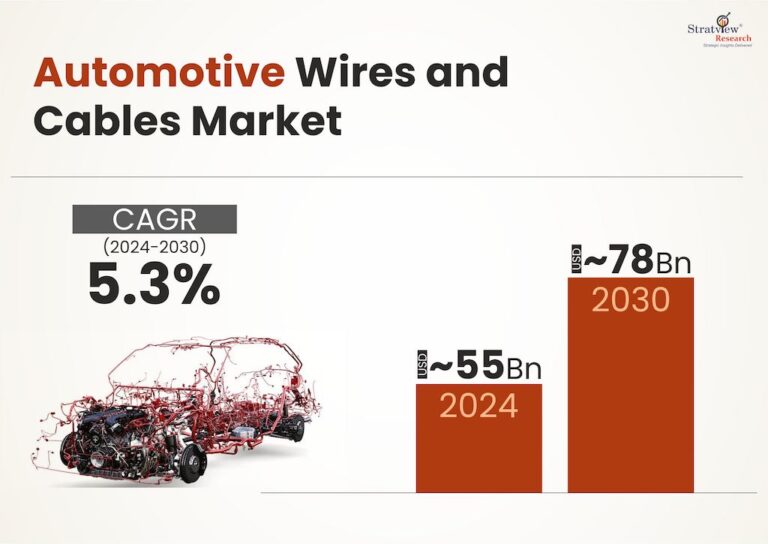

Globally the demand for automobiles is steadily increasing. Forbes reports that international car sales have gained momentum and are projected to rise in 2018, up from an estimated 3.3 percent growth in 2017. 2016 was another record-breaking year with nearly 90 million cars and light vehicles sold globally, up 4.8 percent from 2015.[1]

With no end for car demand in sight, demand for Nylon 6/6 has never been greater.Unfortunately, Chemical and Engineering News projects that the present 200,000-metric-ton shortfall of Nylon 6/6 output could grow to 800,000 metric tons by 2021[2]. The automotive industry relies on it,but the need for Nylon 6/6 is growing at the same time the world supply is decreasing.

Because of its popularity, OEM customers who are standardized on Nylon 6/6 may experience spot shortages.It is therefore essential that they understand the industry’s most utilized logistics models.

Adaptability now can create future success for manufacturers

There are two traditional methods for obtaining Nylon 6/6 – spot purchasing and large contract buying. When it comes to Nylon 6/6 buyers, spot purchasing tends to be used by those requiring smaller amounts of the material, making it a well-established and traditional buying method. When it comes to large contract buying, solutions providers will contract with companies to guarantee them a percentage of their business and in return get a guaranteed contract price and continuity of supply

An example of spot purchasing is when cable tie manufacturers reach out to their suppliers to conduct one-off purchases, which allows manufacturers to shop for the best Nylon 6/6 price at that time and to keep it stored to sell later. This can be advantageous in a long market because the plants have the supply but in a short market, spot purchasers will be at a disadvantage if the supply runs out. This method is especially popular in Asia.

In the U.S. and Europe, most large consumers – those buying six million pounds or more – are large contract buyers. Because companies have been guaranteed the material when utilizing large contract buyers, anything that would decrease the supply of Nylon 6/6 does not negatively affect them. Large contract buyers go to the front of the line for supply when there is an allocation, leaving spot purchasers to get theirs last or not at all. Additionally, being a large contract buyer allows the opportunity to actively seek out alternative sources to the supply.

Breaking down both strategies becomes a risk mitigation exercise. When times are tough, companies and large contract buyers get their Nylon 6/6, no questions asked, which leaves spot purchasers on the outside looking in. While spot purchasing allows various market prices to be sought, the market also dictates this price. The market doesn’t dictate the price of large contract buyer supplies, meaning it’s generally lower, more consistent, and based on what the market is now instead of when it was at the time of the spot purchase. Utilizing spot purchasers is a risk, while depending on large contract buyers provides consistent relief.

It’s no secret that the supply chain of Nylon 6/6 is under extreme, potentially long-term pressure. In the end, utilizing spot purchasers is a risk, while depending on large contract buyers provides consistent relief. Utilizing large contract buyers allows prices to not be made based on out-of-date market prices – whereas a large contract buyer’s supply will have a consistent price, the price of a spot purchaser may reflect the price the materials cost three, six, even nine months ago, making it difficult to gauge what’s a fair offer and what prices going into a potential transaction could be.

Supply May Decrease, But Your Profitability and Productivity Don’t Have To

There are other ways for wire harness manufacturers to ensure their productivity and profitability remain regardless of the state of the Nylon 6/6 industry and supply. By taking these best practices on board, wire harness manufacturers can better manage the changing headwinds in the industry:

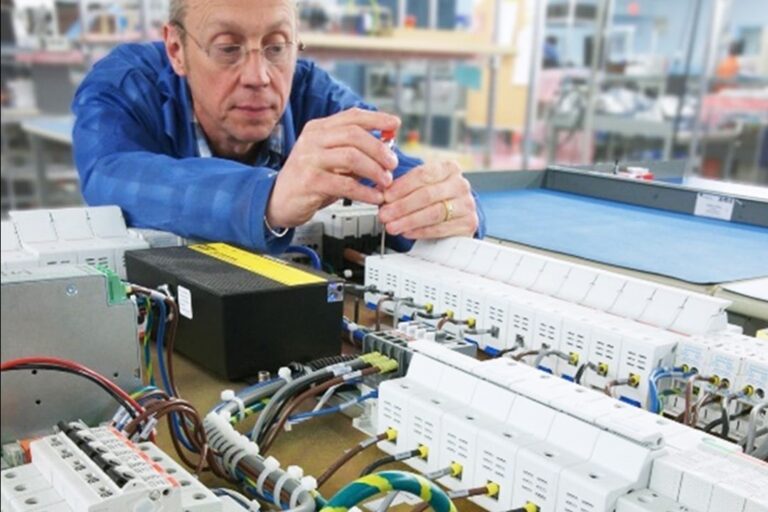

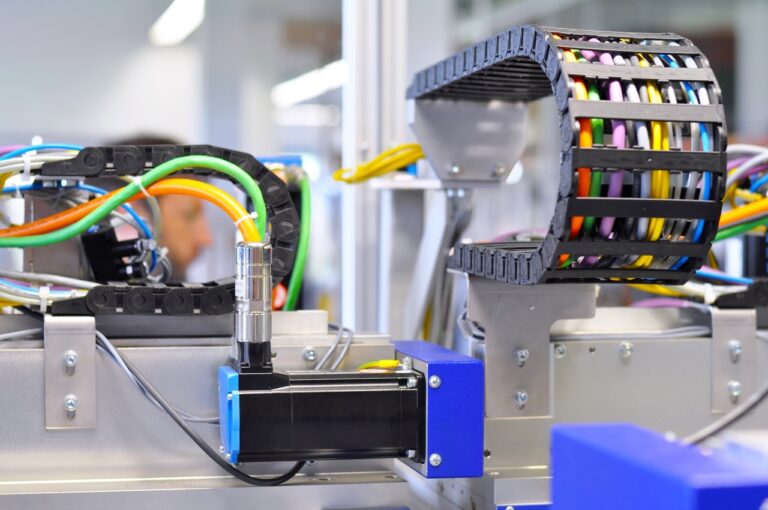

- Reducing downtime: Even with the most experienced workers, manual installations take time and produce less reliable electrical connections. An automated system ensures consistency over the manual alternative while reducing errors and downtime. They’re also faster than manual, leading to an increased overall throughput. Given that impact, investing in an automation system makes good business sense.

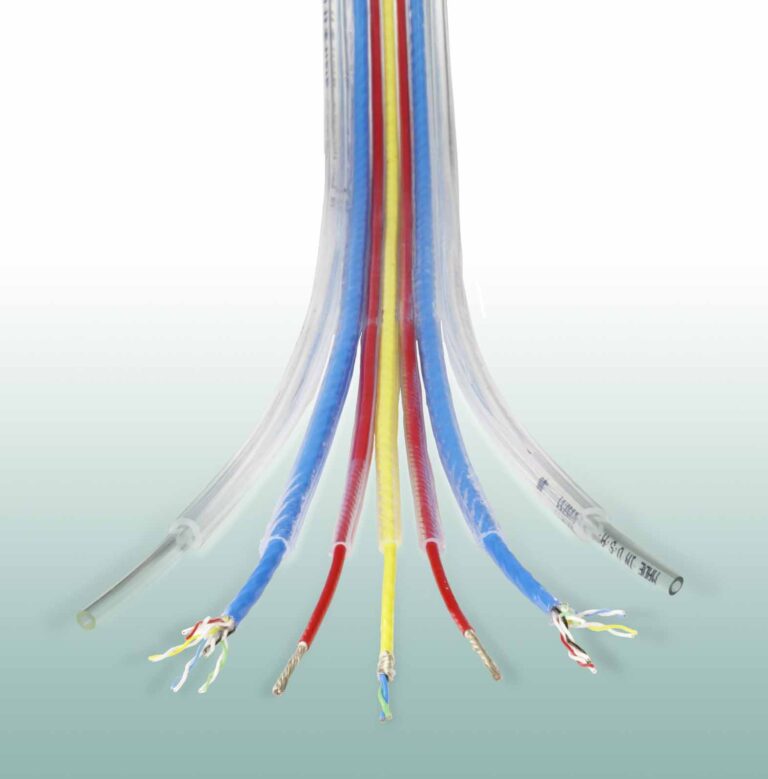

- Improving throughput: By automating certain parts of the manufacturing process, more high-quality wire harnesses will be turned out in a shorter amount of time. This is especially true for the application of cable ties. While they are a relatively easy and cost-effective way of bundling wires in a harness, applying them manually is labor intensive. This is where better tools and automation can be a major improvement.

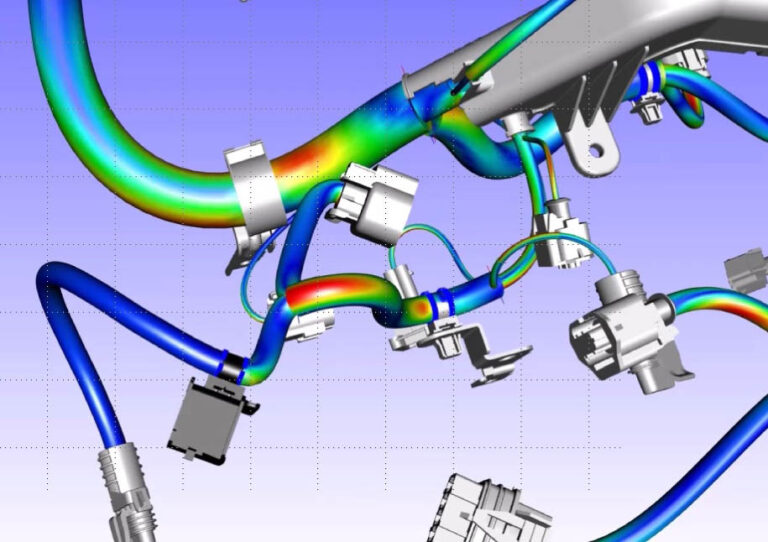

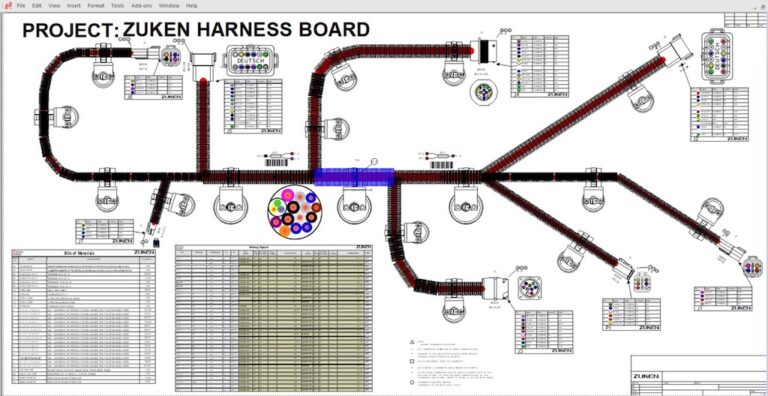

- Being flexible:Traditional harness board assembly has historically been a long and labor-intensive process, and the equipment used reflects the once-popular desire to carefully make something of quality by hand. But over time this has become impractical.Modular system offer an alternative that improves productivity, space utilization, and material quality. Like automated assembly solutions that increase speed and minimize errors, there are harness layout solutions that increase flexibility and minimize costs.

- Focusing on standards:Wire harness assembly being a traditionally manual process has historically left room for variances and quality errors in the final product. By holding your shop to a high level of quality and operational excellence, it signals to customers and others in the industry a commitment to excellence, and this – along with great products – helps attract new business.

Robert Rensa is the Business Development Manager of Wire Management Products for Panduit, a leading global provider of electrical and network infrastructure solutions. Robert has more than 40 years of work experience in sales, product and business management at industry leading companies including Panduit, Eaton, and Furnas Electric (now Siemens Automation). He is also active in industry standards bodies including as the Chairman for NEMA 5FB-2-Wire Management Products, a committee member for NEMA 5FB-2 Technical Committee, Chairman for CANENA-THSC 23A-62275 and technical expert for USNC-SC23A-TAG-WG17 to IEC.

[1]Winton, Neil. “Global Car Sales To Gather Momentum In 2018, While New Technology Disruption Lurks.” Forbes. https://tinyurl.com/y8nqgous.

[2]Tullo, Alexander. “The chemical industry is bracing for a Nylon 6/6 shortage.” Chemical and Engineering News. https://tinyurl.com/y7u75nzy