By Todd Waddle, Director of Sustainability and Wire & Cable, M. Holland

Technologies that traditionally use fossil fuels are shifting to run on electricity instead, furthering clean power and sustainable climate goals. Key drivers of this electrification megatrend include minimizing climate change, maximizing tax incentives, and improving affordability and reliability. Consumer demand and global pressure to reduce greenhouse gases and carbon dioxide emissions are also fueling momentum. The United Nations is driving commitments to reach net zero greenhouse gas emissions by 2050 to preserve a livable planet while combatting climate change.

Sustainability must be part of any long-term business strategy. It is a journey, not a destination. The most effective sustainability initiatives seek continuous improvement over stand-alone goals. These initiatives are necessary to counter climate change. They also satisfy consumer preferences, which increasingly lean toward purpose over price.

Transitioning to electricity from fossil fuels — colloquially called the energy transition — will continue to be a high priority for corporations pursuing sustainability initiatives. Renewable and alternative energy sources are becoming more affordable and reliable. Additionally, businesses helping further the energy transition will see social and financial benefits to the bottom line.

Many electrified technologies require plastic components. As sustainability expectations and demand for electrical and electronic components increase, plastics distributors are becoming valuable partners to wire harness and cable assembly manufacturers.

Profitable Opportunities in the Energy Transition

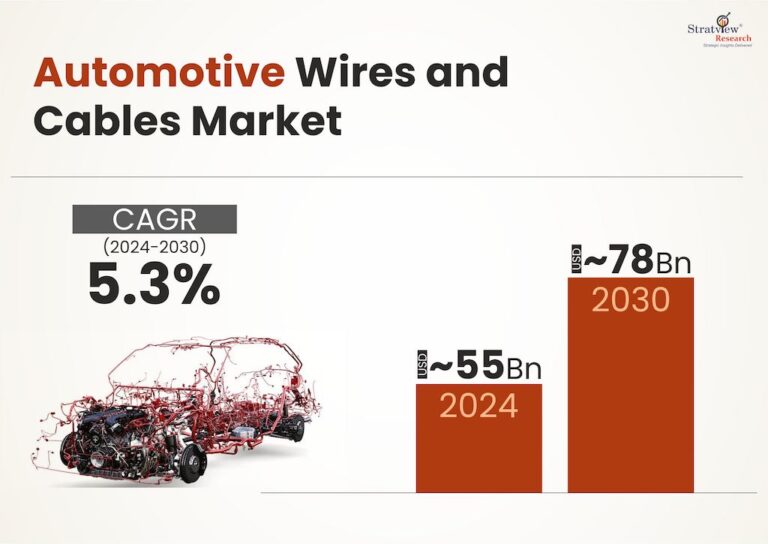

The global transition to clean and renewable electricity will require an additional $1 trillion to $3.5 trillion in average annual capital investment through 2050. These upgrades and supporting legislation like the Inflation Reduction Act (IRA) are creating a positive outlook in the automotive, electrical and electronics, and wire and cable markets. Increased consumer demand for electrified products like electric vehicles (EVs) and energy-efficient appliances also supports the trend. Manufacturers must design and stock products with the energy transition in mind to satisfy the demand for related material components.

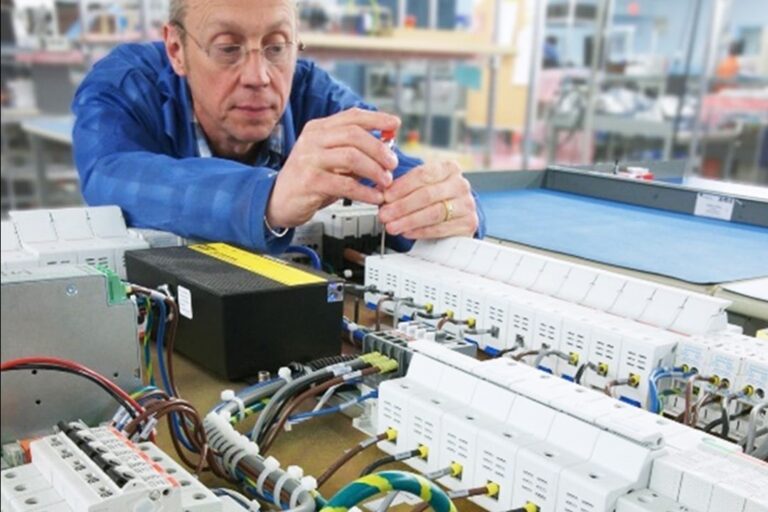

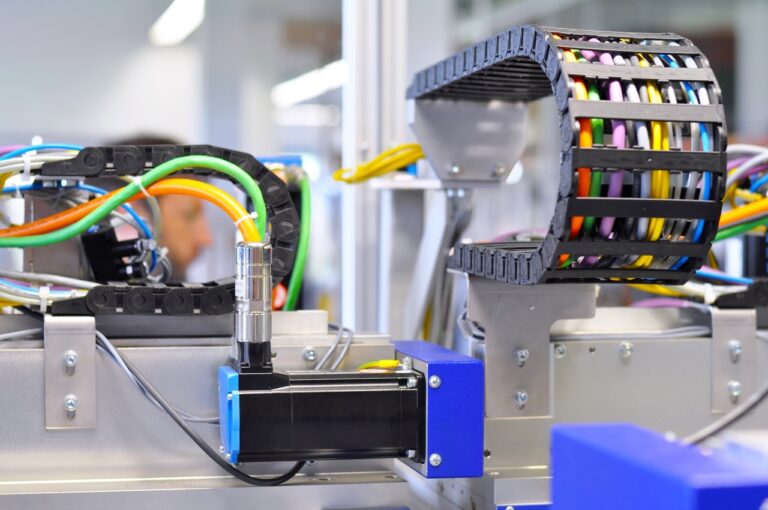

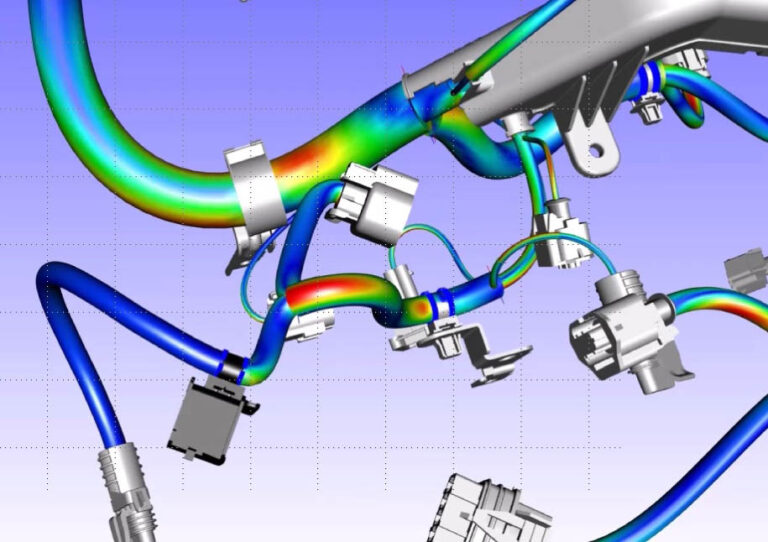

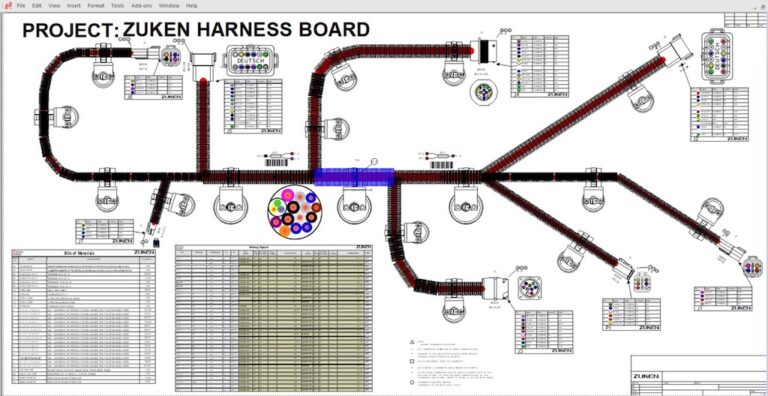

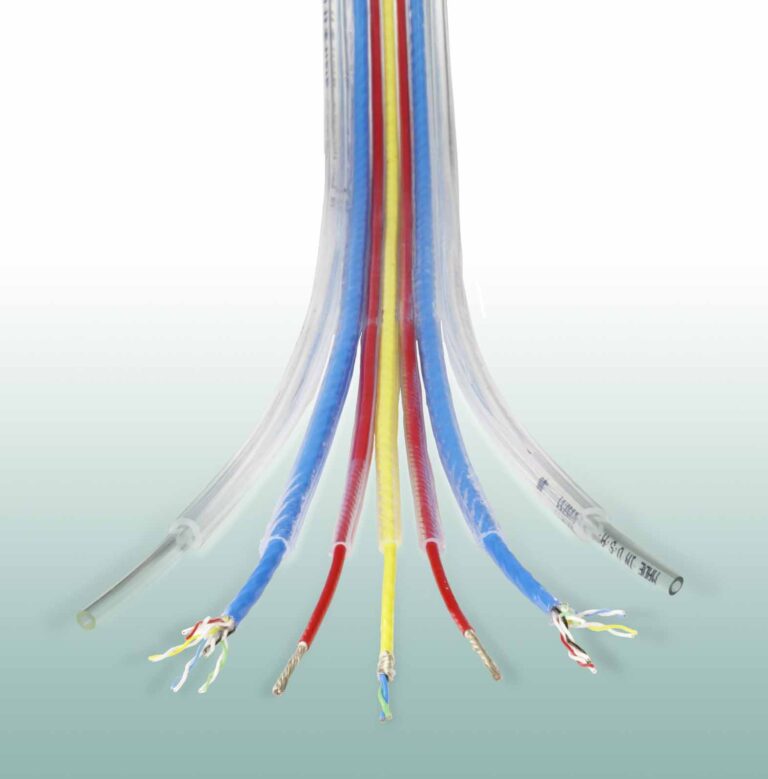

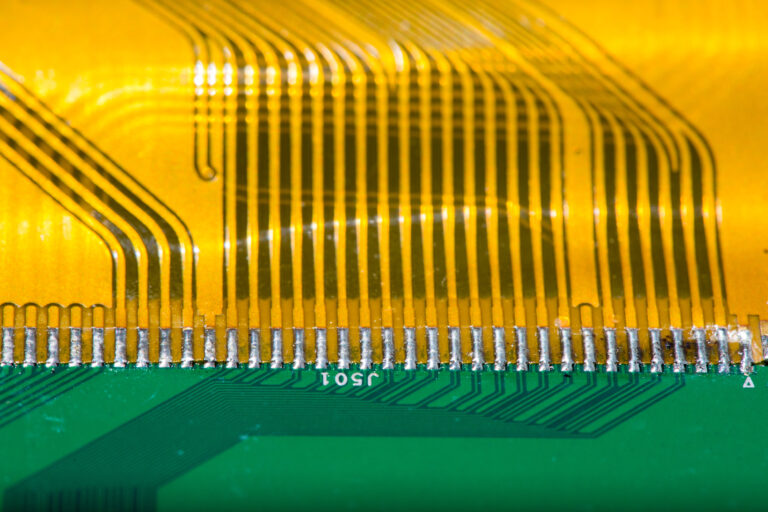

Three areas where plastics innovation and production will be crucial to meeting sustainability demands are electricity infrastructure, EVs and small engines, and energy-efficient building products. Wire harnesses and cable assemblies are essential components for electrified technology and will see great opportunities for business growth as a result. Ensuring products meet current standards for function and sustainability will be important during the energy transition.

Electricity Infrastructure in the U.S.

Massive updates to electricity infrastructure are required to support generation, transmission and distribution in the electrified energy system of the future. Expanding renewable energy and battery storage capacity is a major opportunity for electrical and electronics manufacturers.

In 2022, 23% of U.S. electricity came from renewable sources like wind, solar and hydropower — nearly one-quarter of all electricity used. Continued investment from the IRA and an expected 12.2% increase in electrical demand over the next decade are strengthening the renewable energy sector.

But to truly further renewable energy expansion, legislative support must be paired with corporate sustainability initiatives. For example, a 2022 Solar Energy Industries Association report shared that about half of all corporate solar grids have been installed in the last two and a half years. Corporations have moved beyond the pledge stage of sustainability and now, with government and consumer approval, are putting their plans in motion.

As a result, wind and solar generation and related battery storage are growing as a share of new electric capacity each year. In 2023, these three technologies account for 82% of the new, utility-scale generating capacity developers plan to bring online in the U.S. while nonrenewable sectors are declining. The switch to renewables is everyone’s opportunity; there is no downside.

The aging electricity grid and infrastructure will also need updates to incorporate renewables and improve overall reliability. Charging cables, brackets and pedestals will be prevalent everywhere we go — home, businesses, parking lots, hotels and restaurants. Battery storage will also increase for on- and off-peak demand loading considerations.

Electric Vehicles and Small Engines

The adoption of hybrid and electric vehicles has steadily increased over the last decade, supported by large automotive brands like Tesla and Ford. If the popularity of EVs continues to increase at its current rate, CO2 emissions from cars could reach net zero emissions by 2050. As EVs evolve — offering improved safety features, driver assistance, multiple cameras and power controls — they will need more cabling, cable management harnesses, ties and connectors.

Automotive manufacturers want to build green vehicles from green materials. When reporting on sustainability, automotive OEMs are aggressively focused on recyclability and using recycled content. As demand for electrical components increases, there is an opportunity to incorporate more sustainable plastics and other materials into wire harnesses and cable assemblies.

And car engines aren’t the only ones going electric; electric snowblowers and lawnmowers are also in high demand. The global electric lawnmower market is forecast to surpass $27.4 billion by 2032, signaling a rising opportunity for producers in the small engine market to ride the wave of electrification to increase profitability in small engines.

Energy-Efficient Building Products

The U.S. has an aging infrastructure problem. Roughly 55% of homes and 50% of commercial buildings in the country are over 50 years old. These buildings were constructed before energy-efficient products and practices existed. In the residential and commercial sectors, higher equipment efficiencies and stricter building codes reducing electrical consumption are driving construction demand for electrical components.

These property renovations increasingly call for energy upgrades like microgrids, solar and battery installations, energy-efficient HVAC systems and LED lighting to reduce overall power consumption. All these applications offer a growth opportunity for electrical and electronics producers as most require net-new installations of electrical power-related items.

Moving Forward Sustainably

Successful sustainability programs meet the needs of the present without compromising the ability of future generations to live and thrive. We can no longer afford to be a completely linear society. Circularity, especially regarding materials and the cycle of use and reuse, will be incredibly important to ensure our limited resources remain in use for as long as possible.

It is time to rethink what end-of-life looks like for raw materials and products. We must consider whether a material is reusable as a feedstock. The waste management side of the circular economy is where many producers falter. Distribution partners are pivotal in enabling a circular economy. The simplest solution is for old products to be returned for recycling and remanufacturing when new products arrive.

This practice may seem far-fetched, but it is already happening in the consumer electronics market. Take Apple, for example. Nearly 20% of all material used in Apple products in 2021 was recycled. The brand’s trade-in program and recycling robot Daisy have allowed Apple to reuse finite materials like gold, tungsten and cobalt from existing phones, saving them money and resources while enabling new production.

The electrical industry is seeing increased use of recyclable materials. For example, BASF’s commitment to using recycled and renewable feedstocks is accelerating the incorporation of mechanical recycling into engineering and manufacturing processes. Industry innovation is creating recycled polymers and resins that combine quality, performance and processability to meet existing industry standards.

About M. Holland

M. Holland is a leading international distributor of thermoplastic resins, providing suppliers with the most strategic channels to market, offering clients innovative sourcing and supply chain solutions, and delivering materials that empower sustainable innovation. We provide expert guidance on resin, processes and technologies across various market segments. With deep insight into our suppliers’ technology and innovation pipeline, we advise customers and OEMs on the product offerings that will meet evolving sustainability and electrification requirements. We help our business partners embrace sustainable changes in manufacturing processes and end products.

Headquartered in Northbrook, Illinois, M. Holland has over $1.5 billion in annual sales, partners with more than 4,000 customers annually, and serves over 70 countries across North America, LATAM, EMEA and Asia. M. Holland has offices located in the U.S., Mexico, Puerto Rico and the Netherlands.

For more information on how M. Holland can help your business produce more electrified products, visit www.mholland.com/our-markets/wire-cable. To view our sustainable material offerings, access our Sustainability line card.