Opportunity for harness manufacturers.

By Paul Johnston

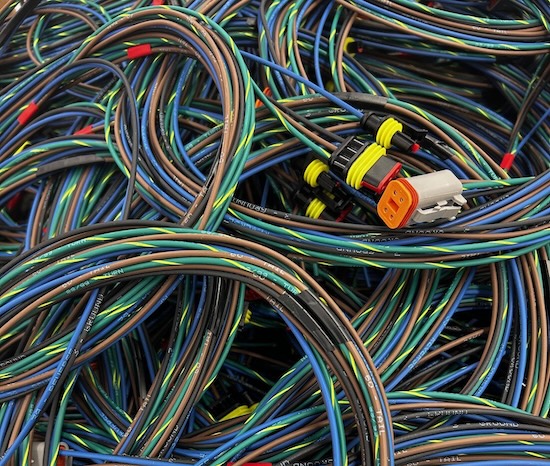

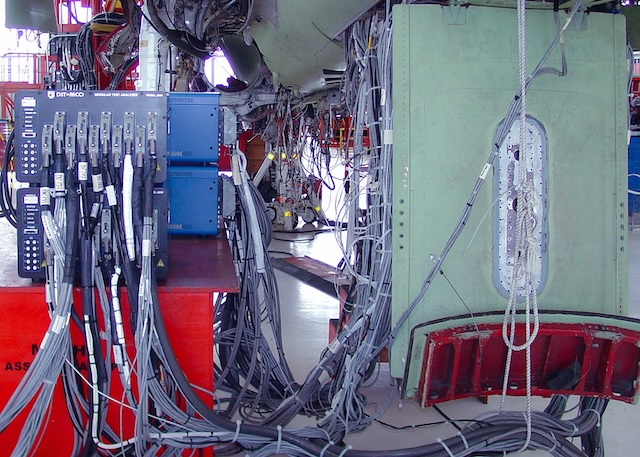

The move to electrification and autonomy is more inclusive and more expansive than wheeled vehicles on the road. Drones, mining equipment, snowmobiles, electrical vertical take-off and landing (E-VToL), construction and agricultural equipment, all-terrain vehicles (ATV’s), zero-turn lawn mowers and commercial street sweepers are all examples of platforms which are being designed to be battery driven and include technologies for Advanced Driver Assistance Systems (ADAS).

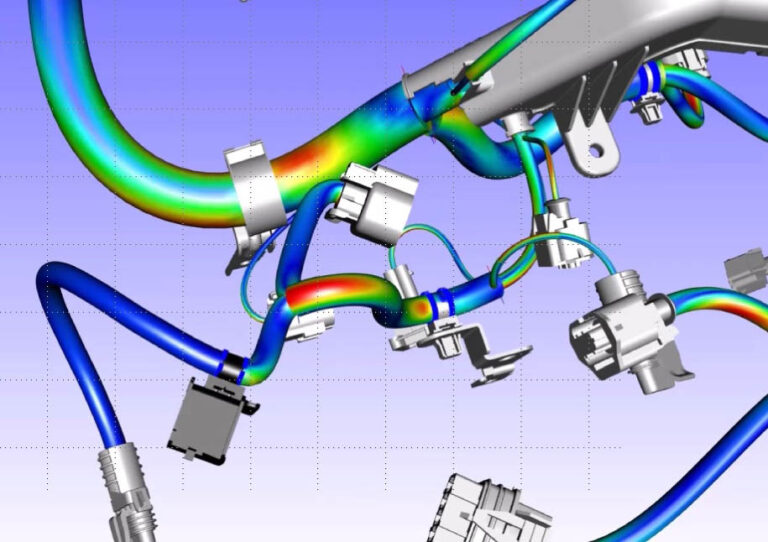

Three sub-trends in design and manufacturing activities for EV/AV transportation platforms’ interconnect by wire can be isolated.

First, a basic theme is that electrical propulsion and autonomous vehicle and driver assist technologies, although having separate origins and goals, are reliant on teams collaborating engineers. Their separate backgrounds and expertise feed off each other to produce next-generation products. Electrical engineers are always firmly in a team context.

The second motif is that this disrupted business environment – when a paradigm of the combustion engine is now giving way to battery electric forms of powering vehicles – generates new opportunities and new revenue streams for wire harness manufacturing. The supplier partners of innovating product designers benefit from their customers’ market leadership.

The third pattern exhibited in this market is one of layered, staggered adoption of the new technologies. Our home market in North America, because of the way the market for complex transportation systems is structured, lags in some (but not all) respects compared to Asia-Pacific and European regions. Both of those regions have business environments which have benefitted from more overtly stimulated growth (incentives and government regulation for example) for electrified transportation over the last 15 years approximately.

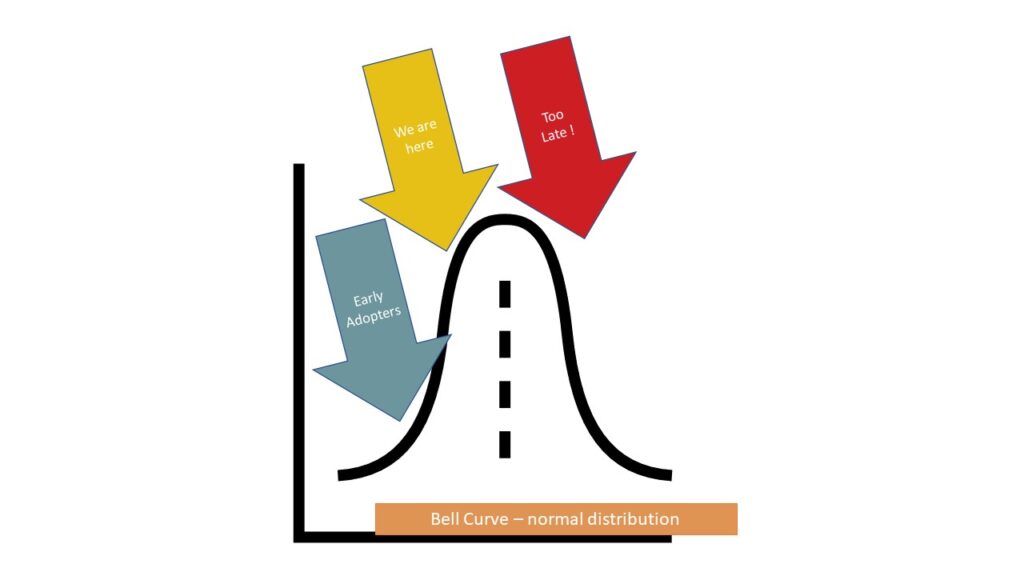

In a conventional bell-curve showing adoption rate of adoption rate, the current USA business environment has left behind early-adopters and we are now moving through early majority with increasing rapidity (fig.1).

Figure 1. Opportunity is ripe NOW for harness manufacturers.

Market changes propel action

The USA EV/AV vehicle market, including manufacturing, has an advantage in the sense it is more flexible and adaptable. In America, investment capital flows can be larger and swifter to emerging technologies and expanding markets.

In summary, the time to act is now. Even for companies with a cautious view of strategic and tactical decision making, you must be aware that joining the later majority in adapting to new technologies or new market conditions is more expensive and outcomes are less certain to be positive.

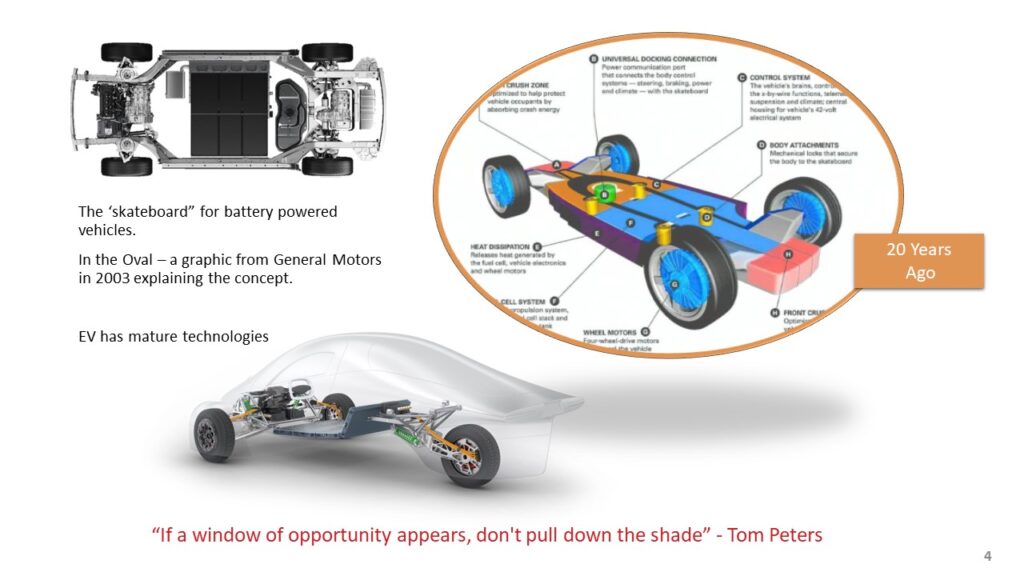

Figure 2. General Motors design concepts from 20 years ago.

The shift in various transportation industries appears to be new and innovative. On further examination the activities, the technologies and the innovation are years and sometimes decades into gaining momentum already. For the design and manufacture of electric battery powered trucks, busses and other forms of transportation, including off-road vehicles, companies have been doing this for years, and refining their design processes (fig. 2).

The situation is different with flying machines because the challenges of getting the power to weight ratio of batteries sufficient for that mode of transport is great compared with those that have been solved and brought to market in other modes. But even in the emerging field of EVTOL (electrically powered vertical take-off and landing & so-called “air taxis”) analysts estimate there are 300 OEM startup companies worldwide are involved in trying to bring various types of piloted and autonomous/drone and aircraft to market.

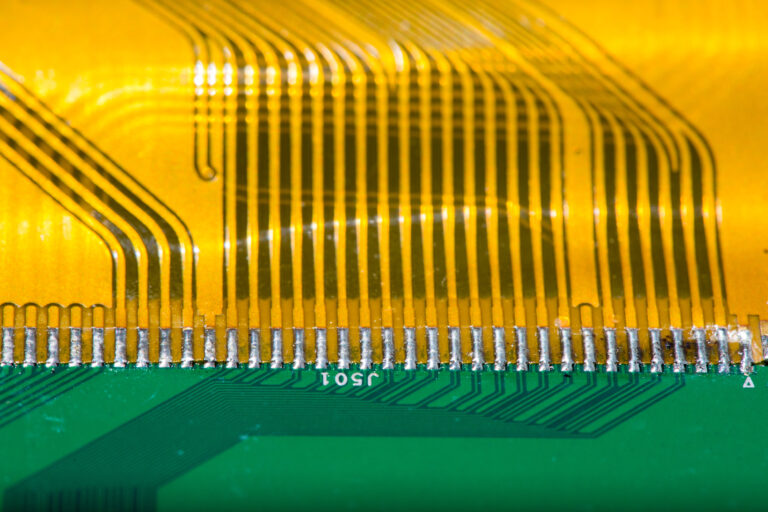

R&D is not the same as full volume production obviously. Over the last two decades, attempts have been made to move away from 12-volt battery systems and to popularize the use of aluminum alloy wires and connector systems in automotive harnesses. Disruption leads to innovation (or attempts to innovate) which may ultimately fail for a variety of reasons. Nonetheless, some get through into production and consumer acceptance.

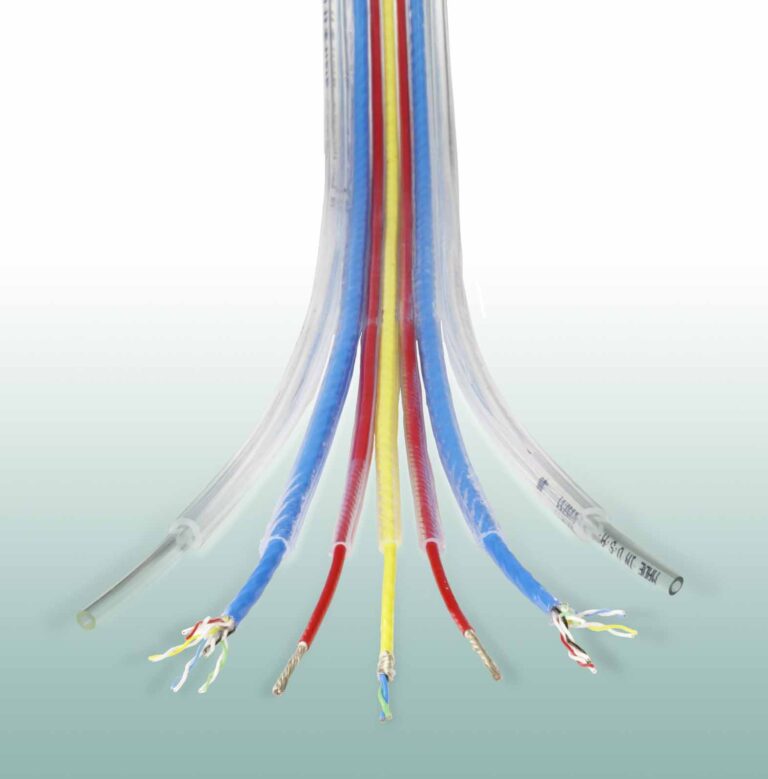

Remember also that one of the consequences of changing what powers these vehicles and platforms to battery propulsion is that, in the majority of cases, there are more wires rather than less. Autonomous driving vehicles entail even more wires, with safety and security redundancy requirements for example. Hydrogen fuel cells used to charge batteries require their own wiring systems.

Many opportunities exist in this disruption and dislocation stage. Businesses that expand during challenging conditions can prosper in easier times. That’s the reward waiting for companies who perform well now and in the near future.

The Inflexion Question

Here is a question fundamental to the state of the market now and in the future:

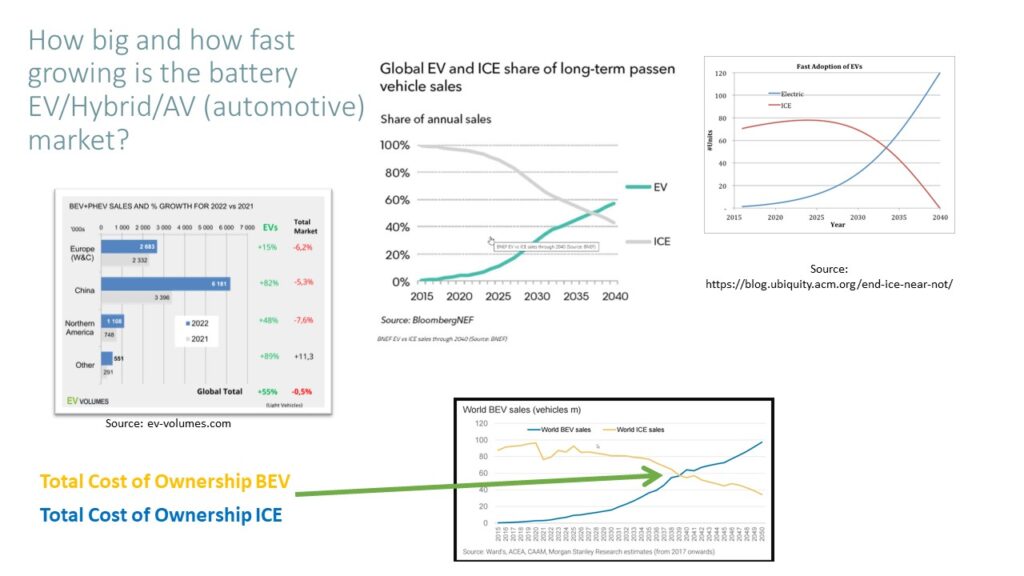

When will the same number of battery-only cars be sold in a year as there are internal combustion engine passenger cars?

Figure 3. Forecast of crossover point from internal combustion to battery vehicles.

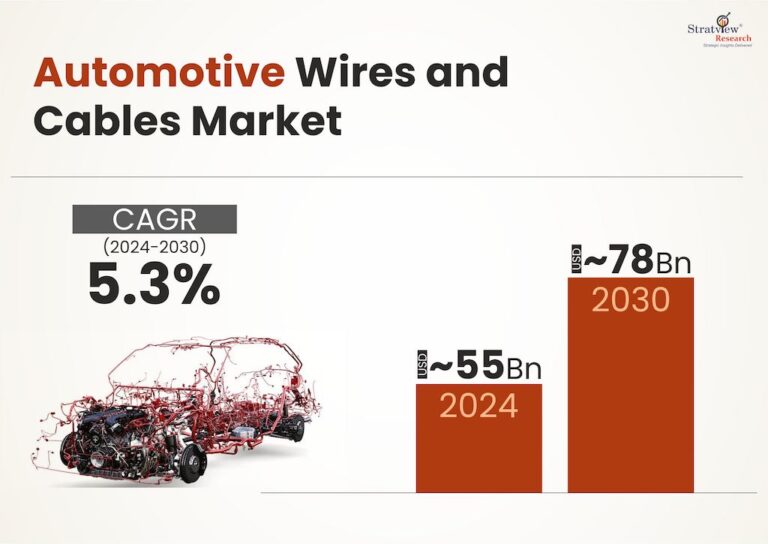

You can see from the sources in figure 3 (and you can research your own in about 15 minutes on the internet) that the current best thinking is a forecast with the crossover point at about 14 years from now for the global market. But the American market will reach that flip-over possibly 2-3 years later. For the sake of argument, let’s agree on 2040. A well-informed estimate is that fifteen to seventeen years from now, over half the new vehicles being produced will be battery-only, with a significant proportion of the rest being hybrid.

Lucrative careers with our expertise in the next 17 years

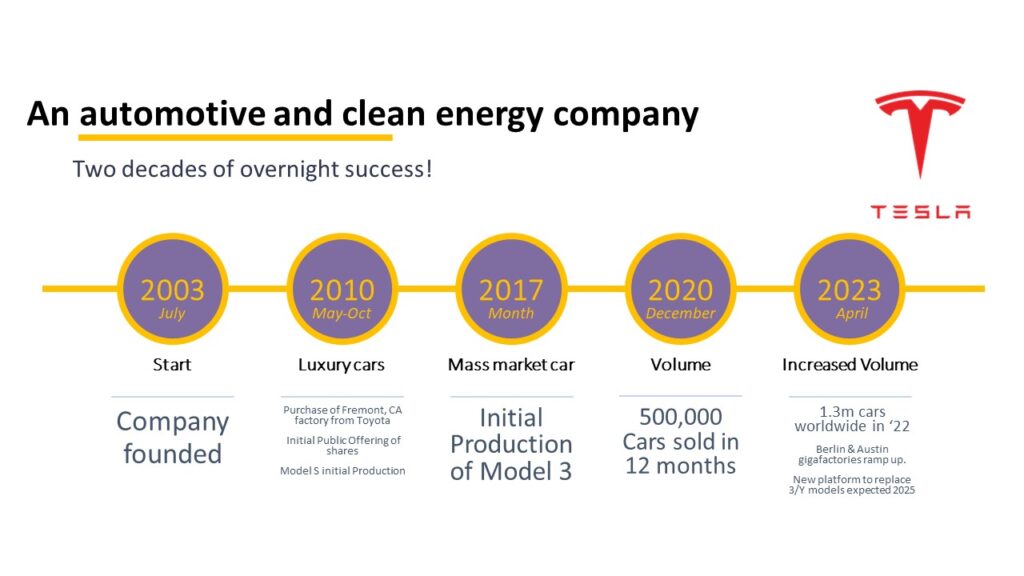

Often, what seems like an overnight success is actually years in the making. Following the trend of calling car companies after scientists, I’m going to honor James Prescott Joule – because he was born in Bridge Street Salford, which is to Manchester in England as St. Paul is to Minneapolis, and I was born about 7 miles north of there. Joule’s law describes the rate at which heat energy is produced from electric energy by the resistance in a circuit.

Assume we secure a couple of billion dollars in funding, recruit engineers and get started. We study re-using the heat produced in the harnesses and batteries and use heat exchange technology to precondition batteries and for keeping passenger cabins toasty in the mid-west winters, the cabin cool in southern states’ summers. Our R&D luck in pioneering and patenting use of near-room- temperature superconducting materials to overcome electrical resistance in motors and in wires makes quite a splash in the market and we are the darling of generation STEM, garnering free publicity.

Figure 4. Twenty-year market cycle of our imaginary Joule Motors.

Joule Motors’ first 5-7 years consist of rounds of investment, R&D patents, and prototype launches, maybe a motorsports record or two. Our high technology and geek appeal translates into sales of a high-end premium car called ‘The Prescott’, anchoring our brand into a high-price bracket in consumers’ minds. This multi-role vehicle comes to market in 2030 and its cachet and good sales figures sustain the company through another big round of funding and developing the mass market offerings. The company learns supply chain management and the basics of volume manufacturing – fast but not as fast as we wanted to. A graphic representation of this can be seen in figure 4.

In 2037 we make a significant splash in Joule Motors converting our proprietary vehicle technologies into a storage and discharge power source which also has a domestic application. Your Joule car is your home heat pump when you park it in your garage. Your vehicle is a supplementary emergency power source for your home, reduces the carbon footprint and cost of domestic heating and cooling barely compromising the transportation benefits & range of the vehicle. This hybrid or combined usage of the powertrain and motor technologies for the vehicles generates another ton of good publicity. We get free hype as our innovation addresses disaster relief and humanitarian search and rescue. We also develop a high-performance paramedic ambulance and design a fire truck platform to sell at near cost.

Nearly fifteen years after forming the company, we at last launch mass market sales of our vehicles marketed to and designed for young professionals. Gradually we move away from our image as a premium platform for transportation. We cultivate our brand image by solving human problems compassionately. We harness our technologies to respond to cold, neglect, poverty, clean air issues and emergency medical facility up time – whilst selling cars which are more profitable than our competition.

Now take a look at this timeline of this real-world company in figure 5. If you were skeptical about a 20-year plan, here are very similar results looking in the opposite direction, from the present back over the last 20 years.

Figure 5. Tesla’s 20-year market cycle.

The learning point here is that our fictitious Joule startup company now, this month, this year, is joining a mature market. Investment is still pouring in to electric and autonomous technologies and companies from all directions. This is the future direction of the market and you are not an early adopter as a wiring harness manufacturer if you are looking at taking on customers who make electric vehicles. You are part of the mainstream – the early and late majority.

Paul Johnston is a Portfolio Development Executive in metro Detroit, Michigan. He works with Siemens DISW’s Capital and Capital Essentials Electrical Design solutions customers who get value out of software automation from architectural studies and model-based systems engineering all the way through to manufacturing with digital continuity.