By Greg Shine – Blue Valley Capital

When contemplating the sale of your wire harness business, one of the most important decisions you’ll face is choosing between an asset sale and a stock sale. This choice is not merely a technical detail—it can shape the entire transaction, influencing your business’s tax liabilities, legal responsibilities, and future trajectory. Understanding the characteristics of these two approaches is essential for securing the best deal and ensuring the sale aligns with your long-term goals and preserves your legacy.

At Blue Valley Capital, we’ve successfully guided numerous business owners through this complex decision-making process. Our experience, with transactions comprising 55% asset and 45% stock sales, has revealed a key insight: the ownership structure of your manufacturing facility often becomes a central negotiation point. This critical aspect can extend timelines and introduce additional complexity, making it a vital consideration for the overall sale structure.

As you prepare to sell your wire harness company, understanding the implications of an asset sale versus a stock sale becomes paramount. This article will guide you through the differences, empowering you to make an informed decision that aligns with your objectives and ensures a smooth transition for you and the buyer.

First, let’s define the two primary ways to sell a business: through an asset sale or a stock sale. Each option has distinct advantages and considerations, which are crucial to understanding as they will help you make the best decision for your situation.

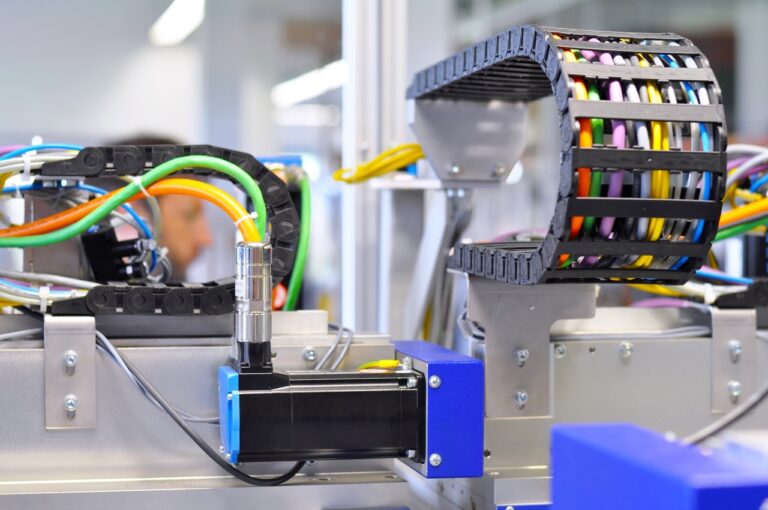

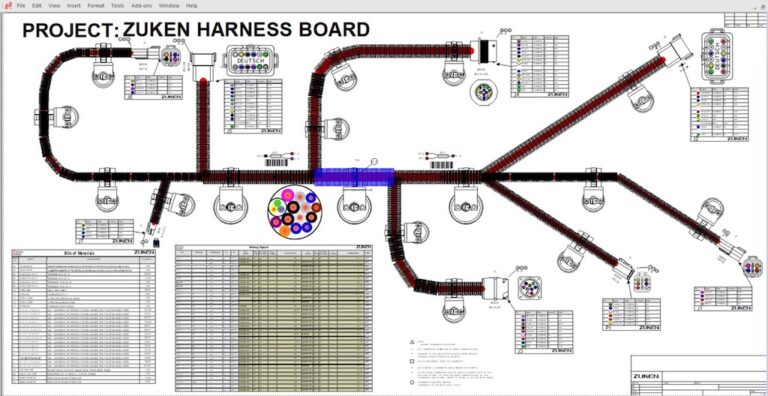

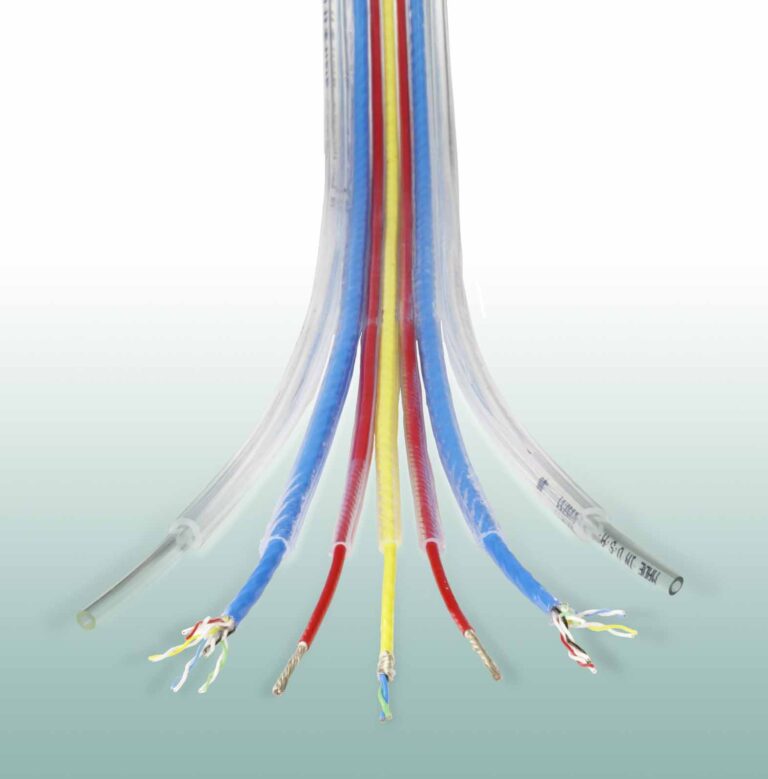

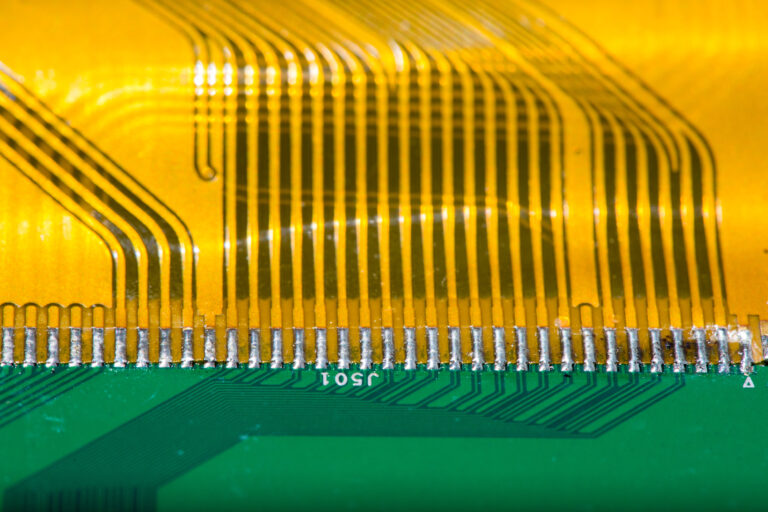

Asset Sales involve transferring specific assets and liabilities from the seller to the buyer. In this scenario, the buyer acquires individual assets such as equipment, inventory, and customer contracts, while the legal entity remains with the seller. Buyers often prefer asset sales because they can selectively acquire assets and contracts without assuming all business obligations.

One significant advantage of an asset sale is the ability to allocate the purchase price to specific assets, offering potential tax benefits. Additionally, buyers can avoid pre-existing liabilities not explicitly assumed in the transaction, providing a cleaner break from the past. However, the process can be complex, often requiring the seller to obtain consent and approvals from various stakeholders, such as suppliers, employees, and landlords, as contracts and relationships may need to be transferred.

On the other hand, stock sales involve transferring ownership of the entire company, including all its assets, liabilities, and contract obligations. The buyer purchases the company’s stock, effectively taking control of the business. Stock sales are typically favored when the buyer seeks to acquire the entire business, including its brand, reputation, and existing contracts. The buyer inherits all its assets, liabilities, and legal obligations by purchasing the company’s stock, resulting in a seamless ownership transition.

A significant advantage of a stock sale is that the legal entity remains intact, meaning contracts and agreements with third parties, such as suppliers and customers, stay in place without extensive renegotiation. This continuity often allows the business to continue operating smoothly without significant disruptions.

Deciding between an asset sale and a stock sale hinges on several factors, including your business’s makeup, the buyer’s objectives, and your preferences as the seller. To navigate this decision effectively, it’s crucial to understand the legal, tax, and operational implications of each approach.

From a legal standpoint, asset sales can be more complicated due to the need to transfer individual contracts and relationships, which can be time-consuming and require complex negotiations. In contrast, stock sales may involve fewer legal hurdles, as the buyer assumes ownership of the existing legal entity. However, it’s essential to be aware of potential contract change-of-control provisions that could affect the stock sale.

Tax implications are another critical consideration. An asset sale may allow you to benefit from tax advantages, such as offsetting gains with capital losses, potentially reducing your overall tax liability. In contrast, a stock sale typically results in capital gains tax for the seller, which could be higher depending on the circumstances. Consulting with tax professionals is vital to fully understand the tax ramifications of each method, as tax laws and regulations can vary depending on the transaction’s jurisdiction.

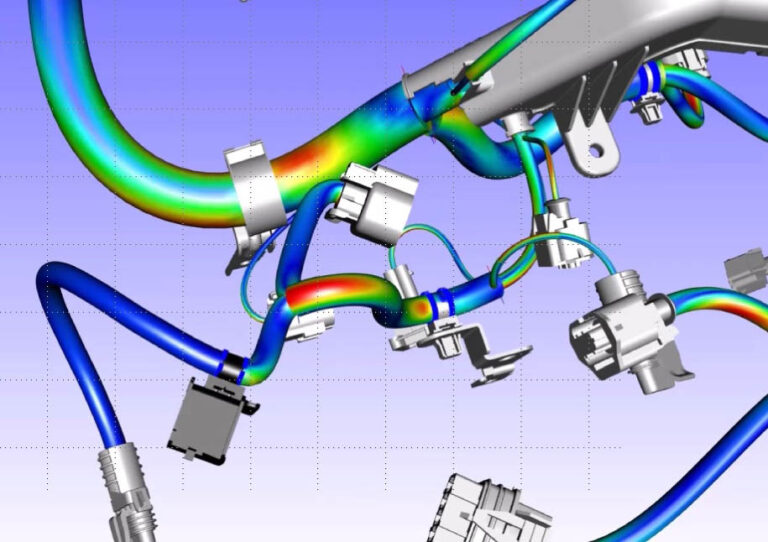

Operational continuity is also a key factor to consider. Asset sales may disrupt business operations, as contracts may need to be renegotiated or transferred to the buyer, potentially causing delays. In contrast, stock sales usually allow the business to continue operating seamlessly, as ownership of the legal entity remains unchanged.

If your business relies heavily on contracts with key suppliers and customers that are not easily transferable, an asset sale might pose more challenges than a stock sale.

How you treat property used in your business during the transaction can significantly impact the deal structure. In an asset sale, you can either sell the property as part of the deal or retain it. If the property is included in the sale, the buyer must explicitly purchase it along with the other assets. On the other hand, if you retain the property, you could lease it back to the buyer, providing an ongoing revenue stream and giving you more control over the property. In a stock sale, the property is typically included as part of the business’s assets, meaning ownership of the property transfers along with the company, simplifying the transaction but potentially exposing the buyer to any liabilities associated with the property.

To decide whether an asset or stock sale is the best choice for your business, it’s important to align the method with your long-term goals and the specific characteristics of your company. If your business is asset-heavy and you wish to retain certain assets or exclude unwanted liabilities, an asset sale may be more appropriate. However, if you aim to transfer the entire entity and ensure a seamless transition for the buyer, a stock sale might be the better option.

When preparing to sell your wire harness business, it’s essential to carefully evaluate the tax implications of an asset sale versus a stock sale, as the financial outcomes can vary significantly between the two. Aligning these considerations with your long-term goals is vital to optimizing the transaction.

Navigating the complexities of selling a business requires more than just understanding the differences between an asset sale and a stock sale. Engaging a sell-side advisor and legal, tax, and financial professionals specializing in business transactions is central to ensuring you make an informed decision that aligns with your objectives. These professionals will assess your unique situation, provide tailored advice, and guide you through the process to maximize the success of your sale.

Whether you choose an asset sale or a stock sale, your decision must be informed by a broad understanding of the benefits, drawbacks, legal and tax implications, and how it may affect your business operations. By working with experienced professionals, you can confidently navigate this process, ensuring you achieve the best possible outcome.